The Rental Evolution

ATTITUDE &

AFFORDABILITY

There is a rising

ambivalence towards

owning almost

everything

There are two major drivers that seem to be fueling the rental evolution: one is the changing attitude towards ownership and the second is affordability. Attitude refers to your mindset towards ownership and how you see the benefits of renting versus owning. Affordability on the other hand, is driven by your purchasing power and actually ability to buy a home. It is a combination of economic factors including, house prices, the availability of reasonable financing and your personal income. These two factors are driving number of renters in the US today.

So how many renters are there?

There are just over 43 million renting households with around 104 million residents occupying them in the US today. That’s about a third of the population and is growing as we added over one million renting households since the 2008 housing crisis that highlighted the many advantages of renting. Lets consider attitude and affordability and how these two high-octane ingredients are fueling the decision to rent.

Cars → ZipCar

Music → Spotify

Movies → Netflix

Housing → AirBnB

The Let’s Rent Everything Attitude

There is a rising ambivalence towards owning almost everything. Nobody seems to want to own stuff anymore from car-buying (ZipCar / Uber) to music listening (Spotify) to entertainment consumption (Netflix), employee hiring (eLance) and now housing like vacation accommodation (AirBnB). Undoubtedly technology is facilitating this evolution, it started with simple services and evolved to impact almost every industry and is being adopted aggressively by younger generations. Of course the rental industry for residential homes has been around for centuries, let’s consider a day in the life my mate Matt. He’s 29, lives in the Bay Area and is married with a two year old and I recently asked him about his view on a rental lifestyle.

“So, last week I drove to work in my leased car, listening to rented music and entered my leased office where the part-time contracted receptionist (she’s rented) greeted me while she worked on the leased photocopier. Later, I discussed over lunch vacation plans to visit the beach apartment I let thru AirBnB and agreed on the movie I’d rent that night on NetFlix when my son was in bed…”

Whether we like it or not, we live in an increasingly rental society. The big push behind this all is that our mindset is changing and our lifestyles are evolving away from ownership. We constantly compare buying versus renting and it makes sense that with your largest monthly expense in life, namely your home that you’d follow a similar train of thought.

Renting offers incredible mobility enabling people to adapt to changing financial climates including the need to relocate to find a more affordable lifestyle or to seek employment elsewhere. The recent nosedive in house prices also emphasized the financial risks of homeownership. Many renters question the age-old assurance of wealth creation through home ownership. They also consider the overall affordability of ownership.

Affordability

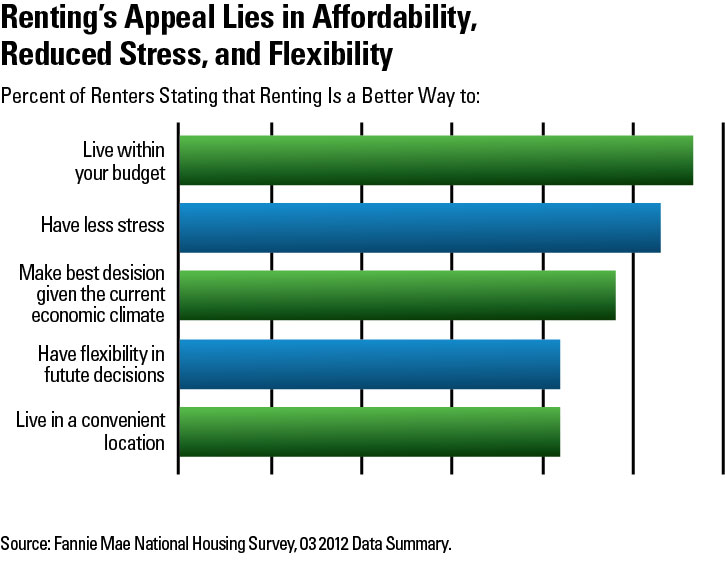

Over half of all renters believe renting is their best option that is according to a 2012 National Housing Survey conducted by Fannie Mae. The study states that 56% of all renters believe they are better off renting to live within their budget. This is a viewpoint I refer to, as ‘I don’t wanna own the roof’

For most people, renting is less of a financial stretch than buying a home. At the get go, homeowners are required to generate a substantial down payment as well as the cost of immediate repairs, while renters typically have to pay a security deposit and the last month’s rent. Ownership requires upfront and ongoing financial reserves.

There is an affordability rule that states a person should invest up to 30% of their monthly income into housing, the rest for groceries, transport and healthcare etc. According to the US Census Bureau the median personal wage (not household) in the US is around $25,000 per annum. A person with this median wage would have to find housing where costs do not exceed $624 a month. This includes ongoing monthly ownership expenses including mortgage, property tax and home repairs. Affordability is one of the largest reasons why there are over 100 million residents of renter occupied households in the United States today. The research below clearly shows affordability as number one concern, but also highlights the other benefits of renting.

ADDITIONAL

BENEFITS OF

RENTING

THE CHANGING

FACE OF

TENANTS

Peace of mind

Not owning a home provides a worry free environment creating sanctuary and comfort. Home ownership requires an ownership mindset needing investment of you time and specific maintenance skills to manage your homes upkeep. Its very similar to the feeling of renting or leasing a car. Your attitude is risk free - you drive it as hard as you want, don’t care about the upkeep, if it breaks down someone else will fix or replace it and you simply return the keys when you’re done with the vehicle. Many people are more suited to renting a home and prefer to pass ownership responsibilities to landlords to simply reduce their stress.

Mobility

Renting a home allows the tenant flexibility to move or upgrade at almost any time, depending upon the lease. It is ultimate freedom compared to long-term how ownership.

Renting clearly provides great benefit and is different for each person. Someone’s decision to rent is personal and requires an examination of your financial situation, potential lifestyle changes (family additions, job changes, and so on) and long-term goals that could impact living arrangements. These change across different tenant demographics, lets take a quick look at the main groups in lifecycle of renters; young singles, families and retirees.

Ownership attitudes and the associated benefits of renting are changing the face of tenants (your customers). The classic image of the renter is the young single person. The young single person is undoubtedly the most common kind of renter but there are indeed multiple demographic groups of renters with specific needs and desires. I’d like to discuss in this section three in particular; young singles, families with children and retirees.

The Young Single Person

When the young single person first takes the road to adulthood and finds a job and a place to live most every time that place to live is a rental. Be it an apartment or a duplex or even sharing a house with some roommates. As this group matures and get more work and life experience then buying a house to live in at some point will be considered. For those of you over 40, you’ll appreciate that the young and single crowd grew up in a rental society and have no idea what it was like to live in a time where you couldn’t just reach into your pocket to make a phone call or brag about what you just achieved to thru pictures, text and video. They equally don’t have a precondition or burning need to own a home at this point in their life. They value their mobility, have affordability barriers and with nearly two-thirds of 25–29 year-olds and more than half of households in their early 30s renting their homes its clear home ownership is not their number one priority.

Now I rent regularly to this group and have found that if screened for sensibility and have a solid profession the biggest concern is looking after your property due to their maturity and secondly vacancy rates due to their mobility. Most move frequently after a year or so due to jobs opportunities - so make sure you bake in an annual vacancy rate equivalent to the national average of around a month (8%).

Families with Young Children

The next group is families with children who are a close second behind young singles accounting for almost as many renters. This group is more stable looking for less flexibility than the young singles desire and is focused on neighborhood for schools and space for children. Historically a large motivator for this group was the social need to own a home because it was expected in society. This driver has been eroded as this group has completely lost the stigma associated with renting your family home. The way we evaluate where you are in society has changed dramatically regarding home ownership in the last decade.

I love this group for leasing single-family homes and if you provide a little extra attention I’ve experienced tenants sign multiple year leases and set expectations of staying for many years to come. I’ve had a family in a 3-bedroom one-bathroom home that each spring I provide a few hundred dollars for investing into a home refresh. I allowed tenants to select some new plants, buy paint to refresh a bedroom and even buy an outdoor table from craigslist and they are eternally grateful.

Retirees

Finally, retirees the baby-boomers often find their needs have changed based on location and size. In addition their overall attitude and view on affordability also evolves. They find they no longer need to live in expensive areas near the office or in good school districts and priorities shift towards walkability. They look for proximity to stores, parks and recreational opportunities.

They find they have major opportunities to rent their home and dramatically reduce living expenses. Retirees often have a need downsize to a smaller place later in life. Once their children leave home, they don’t need as much space and are often motived to move from a multi-story to single-story home eliminating stairs. In addition to space and location, retirees often aspire to outsource their home maintenance in an effort to simplify their lives. With renting it’s the landlord’s responsibility to maintain the property including big-ticket expenses like the roof that can eat into retirement savings, as well as maintain lawns, remove snow and often provide many of the appliances. This is very appealing to seniors as they look to manage to a retirement budget.

I like the profile of this group as a recent study by the Joint Center for Housing Studies of Harvard University projects more than two million Baby Boomers now entering retirement will opt to rent. This older profile of suggests a growing demand for smaller rentals, with good access to transportation and services.

EMPTY NO MORE... VACANCY RATES FALLING

Rental markets have steadily improved for several years based on rental fee and occupancy rates. Whereas the owner occupied housing market only began to recover in the last couple of years and has been concentrated in certain regions. The rental markets vacancy rate has continued improve in the last 4 years averaging 8.4 percent in 2013. The US rental vacancy rate is now well below its average in the 2000’s.

OPPORTUNITY KNOCKS

Rental market indicators appear very positive right now with vacancy rates still falling, rents rising, and the number of renter households increasing. Renters across all walks of life are evaluating options and many have decided that home ownership is not their number one propriety or the key to their American Dream. At least not now. Renters are fluid, they value their flexibility and freedom and the stigma of a “renter” compared to a homeowner has all but vanished. Many renters today look back at what happened during the last decade and have decided they want no part of it. They recognize the value of owning and maintaining stuff is diminishing as they weight up the cost of ownership and risk of obsolescence. That’s the evolution of renting. And real estate investors are taking advantage of this trend all across the country.

SUMMARY

So here is what’s part of the rental evolution

1. Rental appeal for property is driven largely by affordability

2. There is a dramatic shift in attitude away from owing almost everything

3. Overall rental indicators are strong with vacancy rates falling

Good data and clearly delineates the rental trends in the USA. Is this global?

Glad you like the trends. The data around # renters and vacancy rates are US statistics, but the underlying drivers around attitude and affordability clearly work in many western economies around the globe.

Thanks for your time & obvious effort! It may be interesting for me to do a little digging on global rent trends. Sometimes different areas “follow” the US & Western type economies. Could be a bellweather for good global markets in the future… hmmm. Looks like you were up late, thanks for the passion & enthusiasm in this project. So far, I really like it. Will do a little homework this weekend. ;D