Investing Anxiety

The First Door is the Hardest

ANXIETY

IS NORMAL

AT FIRST

This is how it goes—you’re at a party somewhere and you strike up a conversation with an amiable fellow. You speak for a while and exchange the basic information that any initial conversation will have. Where do you live, do you have any kids and of course, “What do you do for a living?” You then find out the person you’re talking to is a real estate investor and has been for quite some time. You’re curious because you’ve been thinking of investing in real estate then you ask, “How many properties do you own?” and the answer floors you. “35” is the response.

That’s a common response from an investor who has been in the industry for a while. But you can also bet that when that same investor considered the very first purchase his legs were a bit wobbly. He was more than just a bit anxious, regardless of the amount of research completed. You can find a property at a good price then have the home inspected and receive a report on what needs to be fixed. You determine the costs to make any repairs and you’ve already lined up your financing. The rent is more than enough to cover the mortgage payments and it all makes sense. On paper. But there is still an air of anxiety. You’re nervous and constantly asking, “Am I doing the right thing here?”

WE'VE ALL BEEN

THERE AT THE

BEGINNING

Do you want to know something? Every real estate investor goes through the same scenario. I compare it to a couple thinking about having their first child. Can we afford it? Are we ready? How will our lives change? Will we lose all our old friends? What about schools? College? But then after the first is born then the rest is easy. At the very least it was nothing like you imagined. You’re a pro now, right?

That’s why it’s not uncommon to run across a real estate investor that owns multiple properties. It’s no longer uncharted waters. The numbers worked out, the price was right and profits are put in the bank account each and every month. Now that you’ve gotten past the first one and have bona fide proof that it works, you want more. And now you’re on your way. But don’t worry about the new case of nerves you’ll get when you go to the settlement table and close on your first property, we’ve all been there.

WHAT AM I DOING?

THIS ISN'T

SO BAD

I KNOW WHAT

I'M DOING

SUMMARY

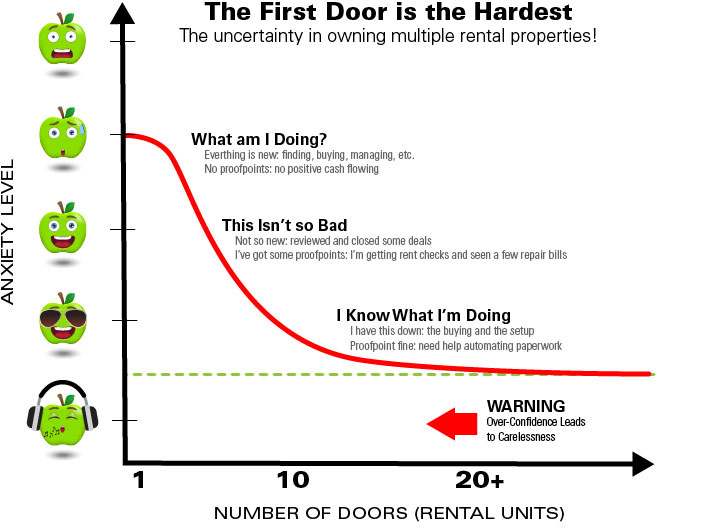

Its easy to visualize how with experience your learning curve drops and along with that your stress level too. At first you exist at the I Don’t Know What I need to Know stress level. You have no experience to to reference and unsure what needs to be done and no crystal ball to see if it your expectations will be accurate. Everything is new and all you have is your assumptions and concerns. At this point you’ll be at a high level of uncertainty across the whole process of planning, finding, assessing, buying and then managing an investment property. It’s all very scary and financial independence feels like a dream.

However, once you have a property or two purchased and some regular cash flowing you realize and operate at the This Isn’t So Bad stress level. You’ve researched some markets, assessed a bunch of deals and gone thru a purchase cycle or two. You’re receiving monthly statements from your property manager and regular deposits in your bank account and have approved repairs to a leaky sink. You’re still unsure of what long-term ownership looks like but found out that all your fears didn’t suddenly occur. You see a clear path to financial independence.

You save some more cash and purchased a few more rentals and now you head into I Know What I’m Doing. Well at least for the buying and getting them set-up and running. You’ve been thru a tax return and re-renting your units and have a feel for actual vacancy times and can forecast your gross income with more accuracy. You’ve probably not sold and exited a property and are looking at how to scale and become more efficient. You’re getting a bunch of mail and need to automate administration and look at options to optimize your portfolio like getting umbrella insurance and reducing underlying unit coverage levels to save money. You’ve reached or close to financial independence.

Here’s the learning in buying your first door

1. Every real estate investor has the same nerves at the beginning

2. Buying your first property has the steepest learning curve and feels the most awkward

3. Most investors rarely buy just one property as it gets easier with experience

4. Don’t become complacent – a constant dose of caution is healthy

That concludes the Getting Started Section. We hope you picked up some of the basics. We created 5 more sections with another 20+ how-to's for the Professional Members. So keep learning and sign up now!

Not Ready to Upgrade? There's so much information out there to absorb.

No need to fret—the Doorsteps Checklist is ready for you to print and reference

after you complete the Getting Started, Plan and Find sections on the web site.

and it’s still hard for the “returning” first door, after being away, then making mistakes from which I’m blessed to have primarily recovered from. Will get my new plans in order and determine where I want to go based on the #’s and start again. Going to redo my plans-short & longer term-based on your model. Thanks, Duncan! Guess I’d better get all of the homework done… then to the next lessons. 😀

This helped me break down my risk factors into manageable issues, my principle concern is what are the risks associated with owning a rental property? This helped me answer that question. thanks

Hey thanks Simon. It’s clear there are benefits to owning a small portfolio and once you’ve owned a few rentals it’s easier to know what to look out for in purchasing new deals and evaluating neighborhoods and management companies.