BUSINESS PLAN BASICS

MAKE A PLAN

√ What you want

√ How to get it

√ Go execute

There was a comic several years ago with a funny stand-up routine and one of his most famous bits was “How to get a million dollars and don’t pay taxes!” His answer to this problem?

“First, get a million dollars. Next, don’t pay taxes!” That was it. Fairly annoying and sarcastic, don’t you think? Of course it’s rather silly but when evaluating how you’re going to gain long-term wealth investing in real estate you can’t just say “I’m going to make a million dollars in real estate.” You have to know how you’re going to get where you want to be. You have to have a business plan. You have to state: what you want, how you're going to get it, and go execute.

WHAT YOU WANT

You need to answer:

Where does your current paycheck go?

This is your goal. You need to clearly identify both in your mind and on paper exactly what it is you want. This is critical in setting out your plan. Have a goal and let that drive your decisions.

You need to answer: Where does your current paycheck go?

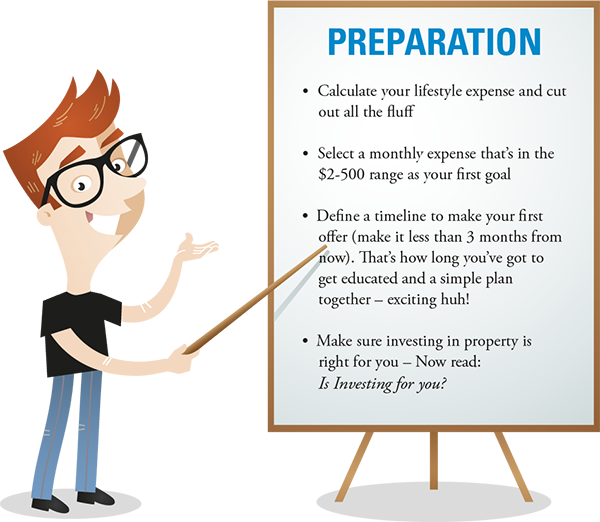

I don’t want to get you too distracted, but this motivator is EVERYTHING. I want you to look at your monthly lifestyle expenses and what you need to live on and then cut out all the stuff you could live without and come up with 6-7 buckets of actual cash needed to live on. Be brutal in cutting (could you live with Netflix and no cable TV if you could quit your job?) this exercise will make your target less scary. The number you come up with is your big scary passive income goal. Now pick one expense item and plan on covering that in the next 6 months with your first property or two. It’s that simple – baby steps. Do you know how to eat an elephant? Yes that’s right - one leg at a time.

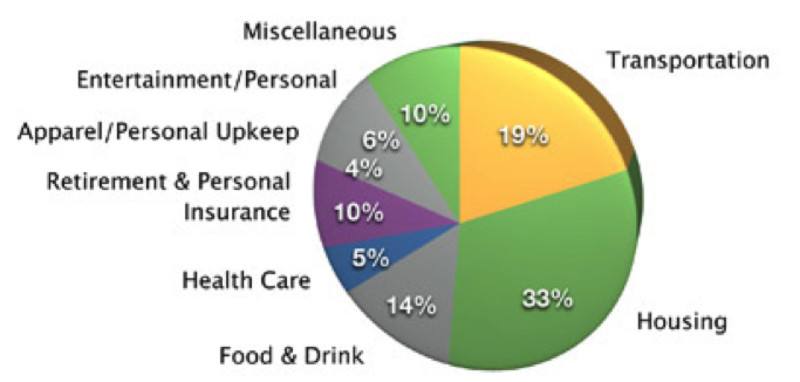

Let’s look at some data. According to the US census, the median household income for individuals over the age of 25 and employed full time is about $45,000. Sounds about right, as an average. After taxes that person is taking home about $34,000 that they can spend about $2,850 per month. According to the Census data, expenditure percentages are fairly consistent for American household expenses, by percentage. Okay, so we don’t all live on the national average but the percentages should be similar. So examine your expenses versus this national average, as it will help rationalize if what you have is reasonable. Now your short-range target is a monthly bill you want to cover with your first rental and move on from there. Below are national averages by percentage.

Once you know you minimum with non-necessities cut out you have your big financial goal (might take 5-10 years to get there) and then the baby step is the first identified expense to get you on your journey to financial independence thru real estate investing.

GETTING MORE SPECIFIC

HOW YOU'RE

GOING TO

GET IT

WHERE AND WHAT TO BUY

EXECUTE

SUMMARY

For those of you looking for something more involved, specific measurable objectives covering passive income, future portfolio valuation and a business mindset goal, mine were as follows:

• An annual net income goal

• An overall equity portfolio valuation target

• Minimize legal and commercial risk

Having goals can’t be stressed enough. Don’t let your business plan be something that’s occupying some space in your head but lay it out in front of you. Write it down and review it regularly.

These objectives break down into goals that each property will contribute until they are achieved. For example: Buy House #1. Invest $20,000 and get $300 per month or $3,600 per year. If your big goal is to create $30,000 of cash flow annually then House #1 would get you 1/8th of the way towards your passive income goal.

(Note when you see future cash flows forecasted with income appreciation and rent increases factored in, then 10 years out this first asset and or building block in your portfolio doesn’t look so shabby). Real estate historically creates long-term wealth and refer to the tree swing house to see how my first house creates $1,000 per month after 9 years and half a million dollars in equity once the mortgage is paid down.

Defining what and where to buy and who is going to help you is the next step in you journey. I pride myself on the ‘how’ part of buying investment properties. The Education Center provides many sourcing strategies and tips based on different lifestyles as well as access to research reports on local markets that I personally like as well as discrete turnkey inventory that’s been renovated and is rented in an attempt to make this easy for you. But for now just consider that your plan needs to mirror your appetite for risk, available funds, time horizons and other factors such as location of relatives etc. where you could get a tax write-off visiting annually.

Lets look at a simple approach (one of many) I call it Turnkey $50k Single Family Homes. It makes sense for your first few deals to look at turnkey properties and single-family residential homes or a small duplex (nothing bigger at the start) in a market with:

• Favorable rental to home price ratios

• Stable employment

• Strong rental cultures

The first criteria allows for a low entry level say a $45-$60,000 single family home that rents for around $800 per month and produces $4-500 cash flow per month in a reasonable neighborhood with average occupancy rates. This probably means buying out of your state so you’ll need a well-vetted property management company and a home that’s been inspected so you know the overall condition. I go into a LOT of detail on sourcing strategies, market specific research and how to evaluate each property later in the Education Center. The second criteria ensures people have jobs to pay for rent so operate in markets where unemployment is within 20% of national average and is on the right trajectory. The Markets section in HowManyDoors covers this is more detail. The final criteria lends itself to locations with reasonable vacancy rates, I like less than 10% and when combined with low entry prices makes for a good ROI.

From here you can build out an annual set of goals that will eventually achieve your specific objectives. I for example, set quarterly goals (public company training means 90 days plans) to make progress against my cash-flow targets and hold myself accountable weekly to tasks and activity to build pipeline, reduce costs, increase rents etc. This doesn’t mean you have to buy a house every three months, but it does mean get educated and make an offer in the next 3 months, and get two rent checks in the following 3 months as a goal to get started. Which means you need to create a simple plan, select a market in the next 4 weeks to hit your first goal of making an offer within 3 months. Soon, you will have a few properties contributing to your first lifestyle expense and can see a path to the next baby step that builds towards your goal of enough monthly cash flow to cover living expenses. You will be able to calculate how many doors you need to be financial independent. Remember it should and will take years to get there and my first step was to buy one property, investing the 20% deposit and see if it worked out.

Now make it happen. You’ve determined what you want and how you’re going to get there and the next step is to execute your plan. There will be missteps and issues that pop up totally unexpected. When that happens it doesn’t mean “Abandon ship!” but make adjustments where needed, reassess your strategy and march on. When things aren’t working your way, ask if your assumptions are correct. Are there enough prospective properties in the area you’re exploring? Is financing readily available for those who buy your properties? Executing a business plan means following the steps laid out and be flexible at the same time. Your business plan can only be honed when making corrections along the way. Remember you can evaluate all deals with the ROI Calculator.

So here’s what you need to consider building a business plan

1. Use your lifestyle expenses to define what you want

2. Define how you’re going to get there in number of properties

3. Go execute. Because a good plan today is better than a perfect plan tomorrow

The homework is great, it is helping me retain all of this valuable information.

Hey Shannon – glad your doing the homework. too easy to skip. BUT you get it – this is how you retain the knowledge…thanks