For Positive Real Estate Cash Flow

Price, Expenses and the People Are Equally Important

Getting real estate to cash flow requires you to buy the right property in the right neighborhood with the right team and rent to the right tenant. In essence you need to be able to buy a home at a decent price, with favorable rents in an area with stable employment.

Real estate cash flow starts with knowing that your property will produce money for you every month. HowManyDoors teaches you the formula to make sure how much you invest plus your monthly expenses will still yield a positive return.

So how can I make my real estate cash flow, you ask? Let’s start by start by pulling out a pencil and paper and learning some simple math to see if you can make a return on your investment. You don’t need to be a college professor but you do need to understand your cash flow calculations.

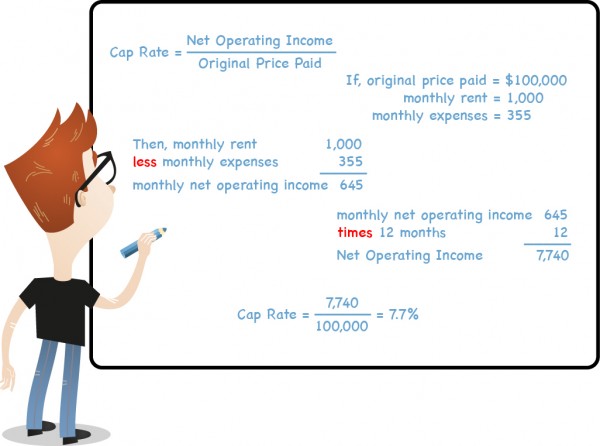

Real Estate Cash Flow and The Capitalization Rate

Creating real estate cash flow requires measuring return and looking at a snapshot of profitability. Below is a snippet of the first metric to understanding how to get your real estate to cash flow.

The cap rate (as I like to call it) is the ratio between the net operating income (money you make after your expenses) produced by your property and the original price you paid, expressed as a percentage.

If you purchase a $100,000 property that rents for $1,000 per month and your monthly expenses are $355 per month, that gives you a net operating income of $645 per month, or $7,740 per year ($645 x 12). To find the cap rate divide $7,740 by $100,000. The cash flow on this piece of real estate would be a 7.7% return on your investment.

To learn the specifics of this example click the article Measuring Return. The expenses are explained in detail, along with an explanation of factoring in vacancies and repairs. All of these are not cut-and-dry and can be tricky when factoring a monthly cash flow.

The Neighborhood

After you’ve learned your math, it’s time to do a little bit of market research and find the right neighborhood. The article, Turn Key Real Estate, contains tips on market research and finding a good neighborhood. Finding a location also means you’ve defined your goals, researched vacancy rates, and looked at the types of jobs in the area. The 10 Tips to Selecting a Location is a helpful tool to start narrowing down locations to find real estate that will produce positive cash flow.

Your Team

If, after clicking around on HowManyDoors, you decide that a turn key property is the way for you to begin building a portfolio check out our list of questions for interviewing turnkey providers and property managers. Asking questions like, how long have you been in business? And, may I please have some references? is a start to building your team. Having the right people on your side will ensure that you will see your real estate cash flow every month.

Take a Virtual Tour

of a Turnkey

Investment Property

Properties like this single-family home have been renovated, independently inspected, are professionally managed and already produce cash flow - a great option for beginners (and pros!) who want to get into real estate investing.

We’re not in

Kansas anymore!

Sometimes the best investment opportunities are in another state. Don’t let that stop you - just bone up on the ins and outs of buying turnkey properties out of state. - Start Now

FREE Tool: Return on Investment Calculator

A great tool for beginners and pros alike who want to know how to invest in real estate. Forecast your cash flow with just an address - try it now