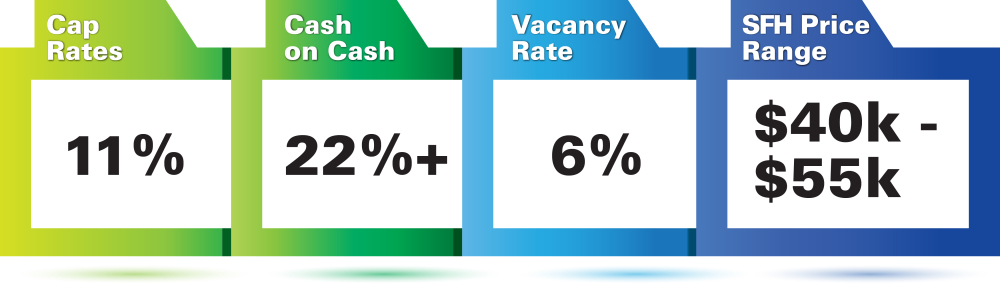

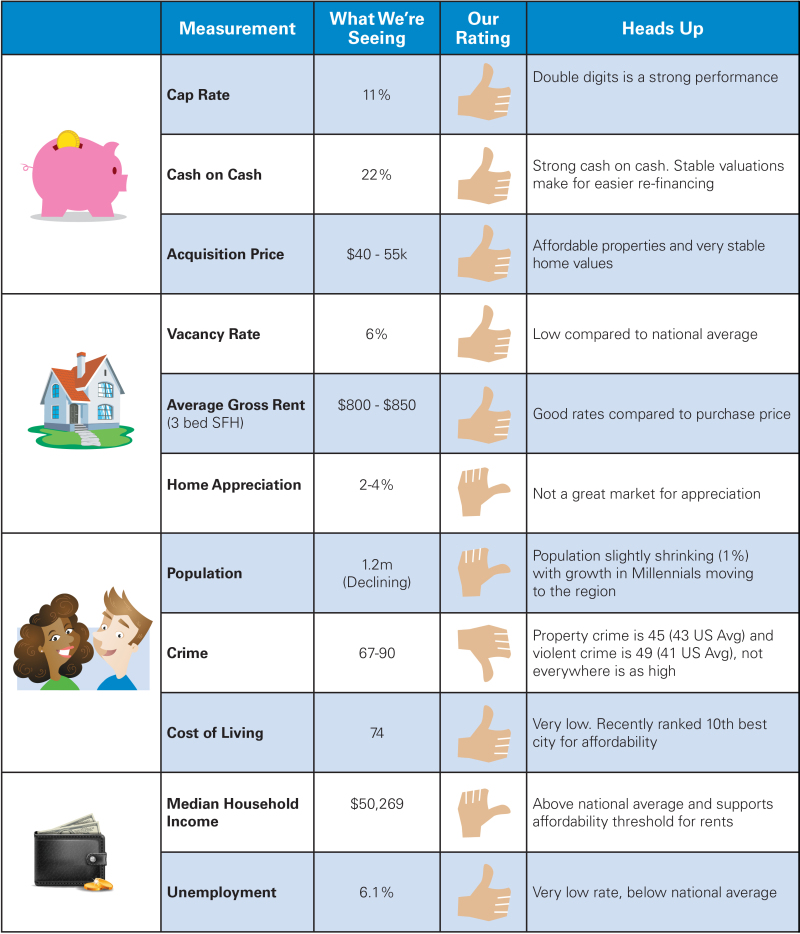

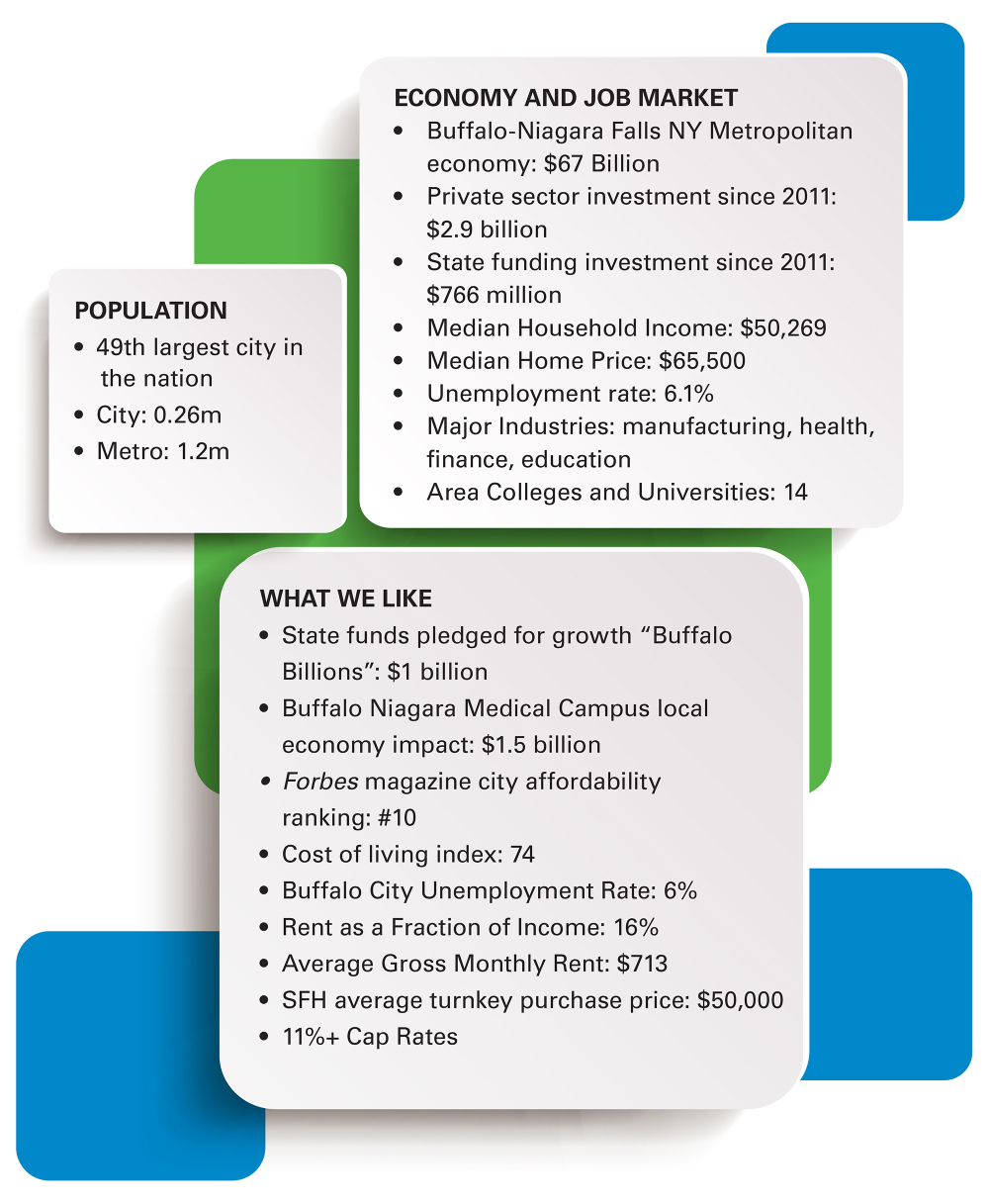

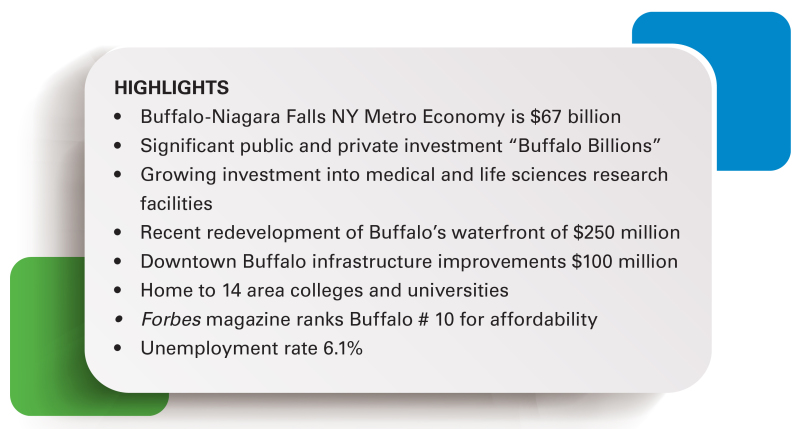

The Buffalo-Niagara Falls, New York Metropolitan region is a $67 billion economy. It is located in Western New York on the eastern shores of Lake Erie and at the head of the Niagara River and hosts a population of 1.2m within the Metropolitan region. The city of Buffalo itself has a population of 261,000. The region has very low unemployment with a rate of 6%. In 2010, Forbes rated Buffalo the 10th best place to raise a family in America. Buffalo has particularly low rental vacancy rates (6%) and attractive low acquisition prices ($40,000 - $55,000) for single-family homes creating 11%+ cap rates and 22%+ cash on cash returns making it a solid income-producing region.

INVESTOR SCORECARD

AT A GLANCE

REGIONAL STATS

MARKET OVERVIEW

Buffalo is the second most populous city in the state of New York after New York City itself. It is the economic and cultural center of the Western New York region. It’s a very affordable place to live with both Forbes and Kiplinger’s Personal Finance magazines ranking it in the 10 best cities for affordability. Buffalo is located about 20 miles south of Niagara Falls, one of the world’s premier tourist attractions drawing over 10 million visitors annually. Toronto, Ontario, is less than two hours away from Buffalo. Tourists, shoppers and theatergoers visiting these popular spots add significantly to Buffalo’s economy. Buffalo refers to itself as the “City of Light” both because of the plentiful hydroelectric power made possible by nearby Niagara Falls and because it was the first city in America to have electric streetlights.

The median income for a household in the Metropolitan area is $50,269 with a median family income of $65,576. The unemployment rate is a healthy 6%. With low home prices and high rental occupancy rates it presents opportunities for turnkey single-family homes at around $40,000 - $55,000 with a cash flow of $5,000 – $6,000 annually.

Economy

The region’s largest economic sectors are health care, manufacturing, technology, financial services and education. In recent years, expansions of the Buffalo Niagara Medical Campus and the State University of New York have led to significant private and public investment throughout the city and region.

The Buffalo Niagara Medical Campus is a world- class, 120-acre medical campus in downtown Buffalo whose total economic impact is $1.5 billion and growing. There are currently 12,000 employees with plans to increase to 17,000 by 2017, and more than one million patients and visitors annually. Of increasing importance to the area’s economy are the University of Buffalo’s two campuses in Buffalo and Amherst, which support more than 50 research centers, some of global importance. Buffalo has been the source of major leaps in research and development, particularly in the life sciences; success stories include creation of the first internal cardiac pacemaker and development of the prostate cancer screening procedure.

Home to Niagara Falls, as well as a broad range of other natural, historic and cultural attractions, Buffalo-Niagara boasts a sizable tourism industry that employs 52,000 workers and generates over $2 billion in annual economic output.

Downtown Buffalo is undergoing urban redevelopment with $100 million in infrastructure improvements and the $250 million redevelopment of the waterfront is providing year-round cultural and recreational spaces, retail, hotel and residential opportunities.

Investment projects like the Buffalo Billion are underway to attract investment into the region. Buffalo’s Governor Andrew M. Cuomo has pledged $1 billion in New York State funds to attract complementary private investment at a 5:1 leverage ratio and ignite growth and purposeful transformation of the region. Additionally, the power of START-UP NY plans to bring new companies and jobs to the region and is already causing a buzz in Western New York where three colleges and universities already established tax-free zones.

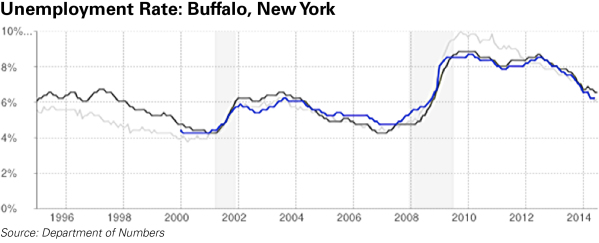

Unemployment is low in the Buffalo Metropolitan region with rate peaking in January 2010 at 8.7% and is now 2.5 percentage points

lower at 6.1%.

IMPORTANT QUESTIONS

Will It Rent?

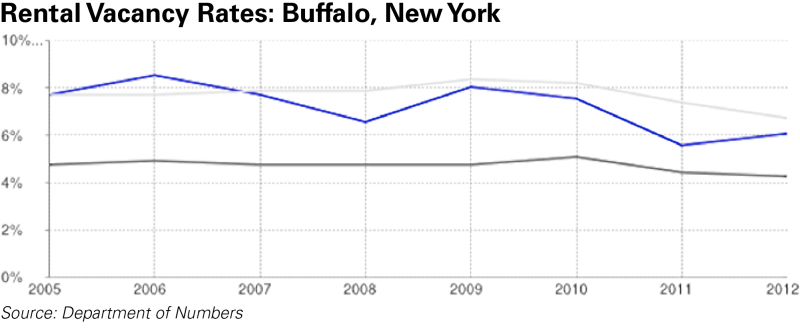

We’ve been watching the Buffalo Metropolitan region and there are some positive trends toward investment properties right now. The low price of inventory compared to other metropolitan areas combined with low unemployment and low vacancy rates are especially appealing. The rental vacancy rate in Buffalo peaked in 2006 at 8.6%. Since then it has fallen by 2.5% to 6.1% according to Department of Numbers data.

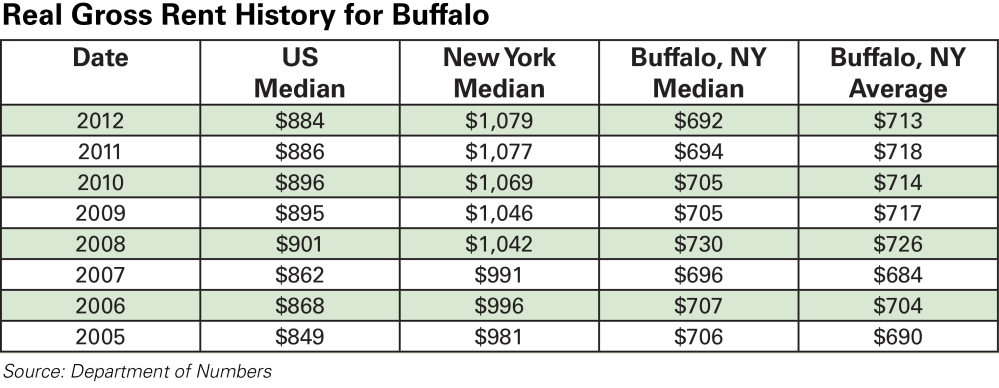

What Do Tenants Pay?

The average monthly gross residential rent in Buffalo, NY is $713 in 2012. We like 3 bedroom single-family homes and the rent fees for 3 bedrooms appear stable around $800 - $850 per month. The most expensive neighborhoods to rent apartments are Allen, Willert Park and Delaware-West Ferry. The cheapest to rent apartments are Riverside Park, Forest and Black Rock.

What About Home Values?

Buffalo is a region known for affordable homes, but they are slow to appreciate. The seven-year growth rate since the housing crisis translates to 2.3% a year, that is steady but not stellar. In the most recent 12 months, home prices rose in Buffalo 4%. Buffalo homes may well see an increase in appreciation from the recent increases in investment in the region. Billions of dollars in public and private investment is pouring into downtown and the suburbs, attracting newcomers, raising confidence and sending a signal that Buffalo is coming back. It is a little early to say if this will translate to higher home prices.

There is an opportunity at the $40,000 - $55,000 price point for fully rehabbed turnkey single-family investment homes. The average price per square foot in Buffalo is $52. The median sales price for homes in summer 2014 was around $80,000. Investors need to be informed particularly of taxes in regions like Cheektowaga offering more affordable housing but facing greater taxes than in comparable areas because of the town’s high school tax rate. Even so, if you purchase at a decent price the taxes can be baked into your return and still produce double-digit cap rates.

What About Population?

Buffalo has an estimated population of 261,000 in 2014. The Buffalo-Niagara Falls metropolitan area has a combined population of about 1.2 million is and the 49th largest in the U.S. Buffalo’s total population is not growing; however, after a decades-long loss of young people, the Buffalo-Niagara area has finally turned things around and is seeing a growth in the number of Millennials (aged 20 through 34) moving to the region. Since 2006, the number of Millennials has grown by more than 10% while the region’s total population shrank 1%. This has been the strongest growth of young people among all counties in New York and exceeds national growth for the age group. Much of this is attributed to the investment in redevelopment of the region and change in industry mix towards financial services, technology, health care and education.

What About Crime?

In the Buffalo-Niagra area, property crime is 45 from a scale from 1 (low) to 100. Property crime includes the offenses of burglary, motor vehicle theft and arson. The object of the theft-type offenses is the taking of money or property, but there is no force or threat of force against the victims. The US average is 43. Violent crime is 49 on the same scale. Violent crime is composed of four offenses: murder; manslaughter; rape; robbery and aggravated assault. The US average is 41. Not all zip codes have the same crime rates.

THE BOTTOM LINE

Buffalo is the economic and cultural center of the Western New York region. It has an attractive

cost-of-living rate with Forbes recently rating Buffalo as the 10th best place to raise a family in America. The province has low unemployment and very attractive vacancy rates. It offers favorable rental-to-home price ratios due to the remarkably low acquisition price for residential real estate. This creates high cap rates of more than 11% and cash on cash returns of 22%+ making it a solid income-producing region. The tradeoff for such strong investment returns is above-average crime rates and lower potential for asset appreciation. Its a strong cash flow market.